PLA is hard to find, and companies such as Levima, Huitong and GEM are actively expanding production. In the future, companies that master lactide technology will make full profits. Zhejiang Hisun, Jindan Technology, and COFCO Technology will focus on layout.

According to the Financial Association (Jinan, reporter Fang Yanbo), with the advancement of the dual-carbon strategy and the implementation of the plastic restriction order, traditional plastics have gradually faded out of the market, demand for degradable materials has grown rapidly, and products continue to be in short supply. A senior industrial person in Shandong told a reporter from the Cailian News, “With the advantages of low-carbon and environmental protection, the market prospects for degradable materials are very broad. Among them, the biodegradable materials represented by PLA (polylactic acid) are expected to be degradable. The advantages in speed, industry threshold and production technology are the first to break the game.”

A reporter from the Cailian News Agency interviewed a number of listed companies and learned that the current demand for PLA is booming. With the current supply in short supply, the market price of PLA has been rising all the way, and it is still difficult to find. At present, the market price of PLA has risen to 40,000 yuan/ton, and analysts predict that the price of PLA products will remain high in the short term.

In addition, the aforementioned industry sources stated that due to the certain technical difficulties in the production of PLA, especially the lack of effective industrial solutions for the synthesis technology of the upstream raw material lactide, companies that can open up the entire industry chain technology of PLA are expected to share more Industry dividends.

Demand for PLA materials is booming

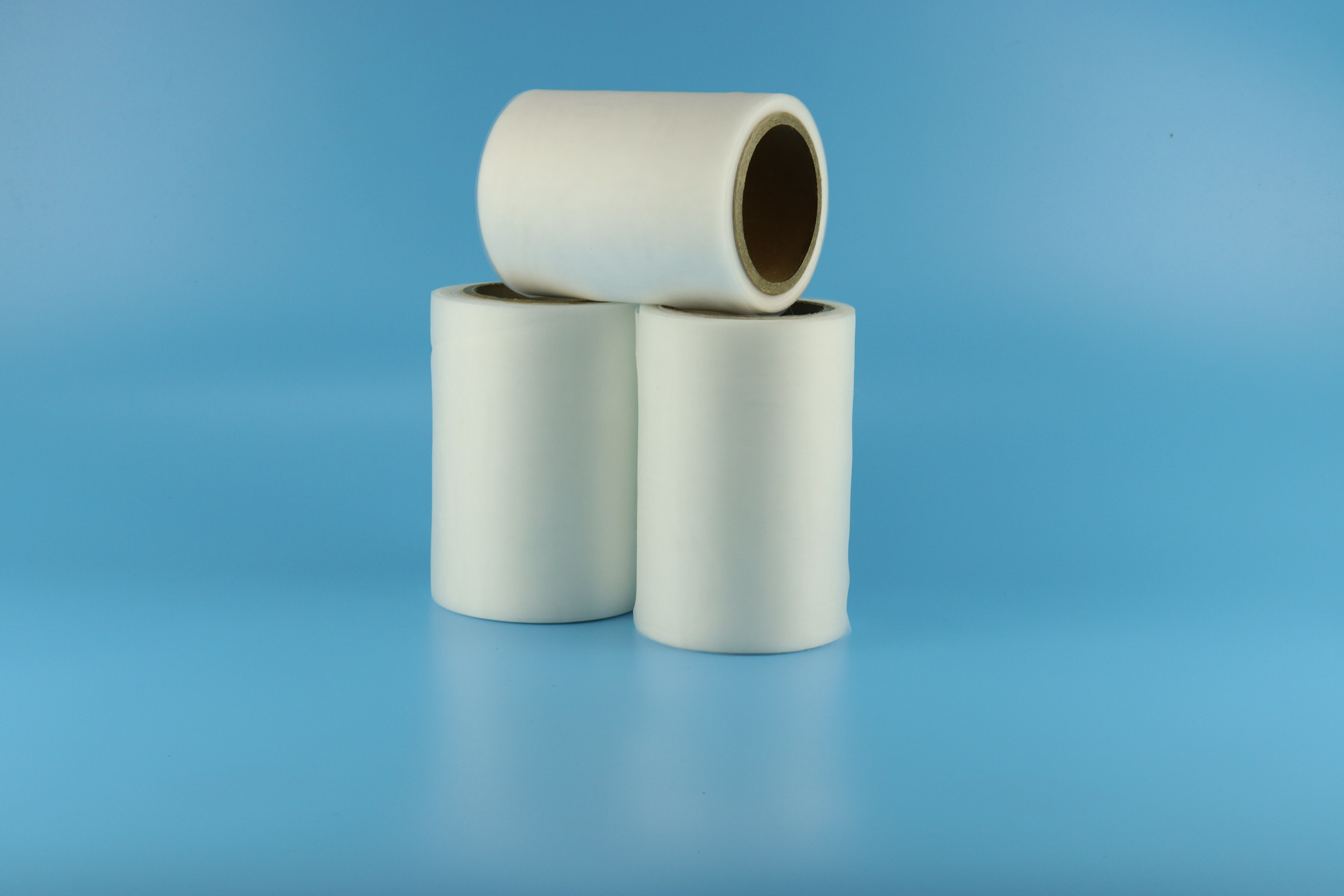

Polylactic acid (PLA) is also called polylactide. It is a new type of bio-based material produced by dehydration polymerization of lactic acid as monomer. It has the advantages of good biodegradability, thermal stability, solvent resistance and easy processing. It is widely used in packaging and tableware, medical treatment and personal care. , Film products and other fields.

At present, the global demand for degradable plastics is growing rapidly. With the implementation of the global “plastic restriction” and “plastic ban”, it is expected that more than 10 million tons of plastic products will be replaced by degradable materials in 2021-2025.

As an important biodegradable material variety, PLA has obvious advantages in performance, cost and industrial scale. It is currently the most mature industrialized, largest output, most widely used, and lowest cost bio-based degradable plastic. Analysts predict that by 2025, the global demand for polylactic acid is expected to exceed 1.2 million tons. As one of the fastest growing markets for polylactic acid, my country is expected to reach more than 500,000 tons of domestic PLA demand by 2025.

On the supply side, as of 2020, the global PLA production capacity is approximately 390,000 tons. Among them, Nature Works is the world’s largest polylactic acid manufacturer with an annual production capacity of 160,000 tons of polylactic acid, accounting for approximately 41% of the total global production capacity. However, the production of polylactic acid in my country is still in its infancy, most of the production lines are small in scale, and part of the demand is met by imports. Statistics from the State General Administration of Customs show that in 2020, my country’s PLA imports will reach more than 25,000 tons.

Enterprises actively expand production

The hot market has also attracted some corn deep-processing and biochemical companies to set their sights on the blue ocean market of PLA. According to the data from Tianyan Check, there are currently 198 active/surviving enterprises that include “polylactic acid” in the business scope of my country, and 37 new ones have been added in the past year, a year-on-year increase of nearly 20%. The enthusiasm of listed companies for investment in PLA projects is also extremely high.

A few days ago, the domestic EVA industry leader Levima Technologies (003022.SZ) announced that it will increase its capital by 150 million yuan in Jiangxi Academy of Sciences New Biomaterials Co., Ltd., and hold 42.86% of the shares of Jiangxi Academy of Sciences. The relevant person in charge of the company introduced that the capital increase to the Jiangxi Academy of Sciences will realize the company’s layout in the field of biodegradable materials and cultivate new economic growth points for the company’s subsequent development.

It is reported that the Jiangxi Academy of Sciences is mainly engaged in the research and development, production and sales of PLA, and plans to construct the “130,000 tons/year biodegradable material polylactic acid whole industry chain project” in two phases by 2025, of which the first phase is 30,000 tons/year. In 2012, it is expected to be put into operation in 2023, and the second phase of 100,000 tons/year is expected to be put into operation in 2025.

Huitong Co., Ltd. (688219.SH) also launched a 350,000-ton polylactic acid project in April this year with the Anhui Wuhu Sanshan Economic Development Zone Management Committee and Hefei Langrun Asset Management Co., Ltd. by investing in the establishment of a project company. Among them, the first phase of the project will invest about 2 billion yuan to build a PLA project with an annual output of 50,000 tons, with a construction period of 3 years, and the second phase of the project will continue to build a PLA project with an annual output of 300,000 tons.

Recycling leader GEM (002340.SZ) recently stated on the investor interaction platform that the company is building a 30,000-ton/year degradable plastic project. The products are mainly PLA and PBAT, which are used in blown film injection molding and other fields.

The PLA production line of Jilin COFCO Biomaterials Co., Ltd., a subsidiary of COFCO Technology (000930.SZ), has achieved mass production. The production line is designed to have an annual production capacity of about 30,000 tons of polylactic acid raw materials and products.

The domestic lactic acid leader Jindan Technology (300829.SZ) has a small trial production line of 1,000 tons of polylactic acid. According to the announcement, the company plans to have an annual production of 10,000 tons of polylactic acid biodegradable new material project. As of the end of the first quarter, the project has not yet started construction.

In addition, Zhejiang Hisun Biomaterials Co., Ltd., Anhui Fengyuan Taifu Polylactic Acid Co., Ltd., Zhejiang Youcheng Holding Group Co., Ltd., and Shandong Tongbang New Material Technology Co., Ltd. all plan to build new PLA production capacity. Analysts predict that by 2025 In 2010, the annual domestic production of PLA may reach 600,000 tons.

Companies that master lactide production technology may make full profits

At present, the production of polylactic acid by the ring-opening polymerization of lactide is the mainstream process for PLA production, and its technical barriers are also mainly in the synthesis of PLA raw material lactide. In the world, only Corbion-Purac Company of the Netherlands, Nature Works Company of the United States, and Zhejiang Hisun have mastered the production technology of lactide.

“Because of the extremely high technological barriers of lactide, the few companies that can produce lactide are basically self-produced and used, which makes lactide a key link that restricts the profitability of PLA manufacturers,” said the aforementioned industry insider. “At present, many domestic companies are also opening up the lactic acid-lactide-polylactic acid industrial chain through independent research and development or technology introduction. In the future PLA industry, companies that can master lactide technology will gain obvious Competitive advantage, so as to share more industry dividends.”

The reporter learned that in addition to Zhejiang Hisun, Jindan Technology has focused on the layout of the lactic acid-lactide-polylactic acid industry chain. It currently has 500 tons of lactide and a pilot production line, and the company is building 10,000 tons of lactide production. The line started trial operation last month. The company said that there are no obstacles or difficulties that cannot be overcome in the lactide project, and mass production can only be carried out after a period of stable operation, but it does not rule out that there are still areas for optimization and improvement in the future.

Northeast Securities predicts that with the gradual expansion of the company’s market and the commissioning of projects under construction, Jindan Technology’s revenue and net profit in 2021 are expected to reach 1.461 billion yuan and 217 million yuan, a year-on-year increase of 42.3% and 83.9%, respectively.

COFCO Technology also stated on the investor interaction platform that the company has mastered the production technology and processing technology of the entire PLA industry chain through technology introduction and independent innovation, and the 10,000-ton level lactide project is also steadily advancing. Tianfeng Securities predicts that in 2021, COFCO Technology is expected to achieve revenue of 27.193 billion yuan and net profit of 1.110 billion yuan, a year-on-year increase of 36.6% and 76.8% respectively.

Post time: Jul-02-2021